Bitcoin has always been known for its cycles. The classic pattern accumulation, breakout, distribution, correction has repeated several times over the last decade. But the question today is whether we’re still living in that cyclical world, or if the game has changed now that institutions dominate flows. With ETFs, custodians and funds moving billions at once, the market doesn’t always behave like the retail-driven cycles of the past. It feels more like liquidity management on Wall Street than the old “four-year rhythm” that many still expect.

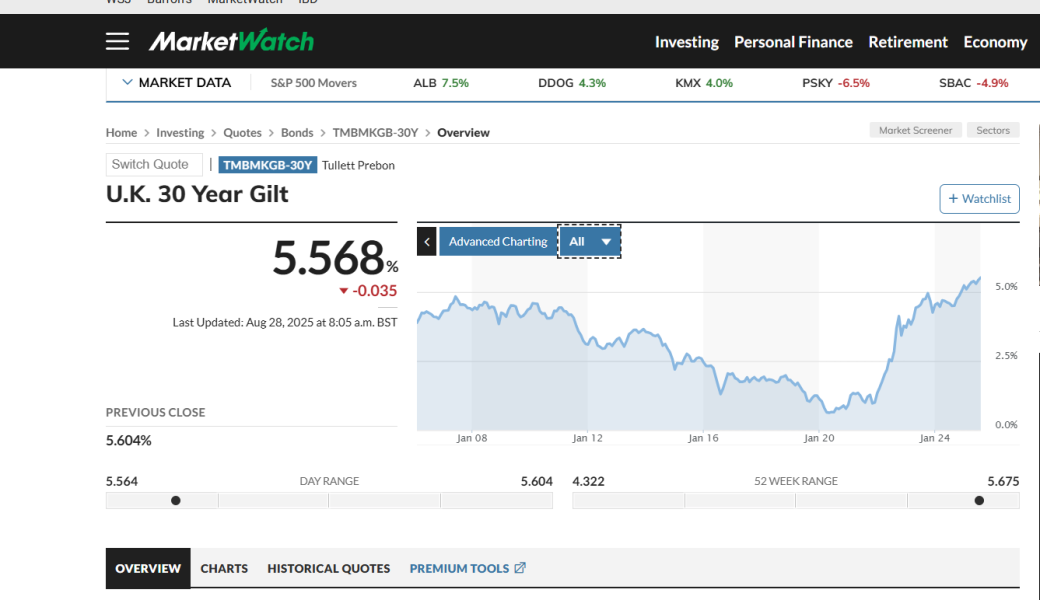

This month has been a reality check. September price action for BTC looks bearish. Each rally attempt has been smothered by resistance and we’re printing lower highs while support levels weaken. The biggest risk for Bitcoin isn’t technicals, it’s macro. A strong US economy, hotter inflation signals and the chance of rising interest rates are poison for risk assets. Instead of the Fed cutting aggressively, markets are being forced to price in the possibility of more tightening. That pressure lands directly on Bitcoin, which has grown into a macro-sensitive asset whether we like it or not.

Meanwhile, gold is telling a very different story. It keeps printing fresh all-time highs while BTC struggles to find direction. That divergence is important: investors are clearly looking for safe havens, and for the moment, gold is taking the spotlight. It doesn’t mean Bitcoin’s narrative as “digital gold” is dead, but it does highlight that BTC is not yet the first choice when fear of inflation or rates picks up. Institutions that once promised to treat BTC as a hedge are behaving like any other macro trader, they sell when liquidity tightens.

Altcoins have taken the hardest hit this month. September has been brutal, with double-digit losses across the board. Historically though, this isn’t unusual. In almost every cycle, alts bleed heavily when Bitcoin shows weakness. Retail tends to flee risk, institutions don’t bother catching falling knives, and suddenly every token looks like dead weight. The irony is that this phase often lays the groundwork for the next rotation: once Bitcoin finds a bottom or consolidates, altcoins are usually the first to snap back with outsized gains. The cycle of pain and revival repeats, even if the drivers behind it are shifting.

So are we still in a Bitcoin cycle, or is this now just a macro-driven market run by funds and central banks? The truth is probably both. Human psychology doesn’t vanish, and neither do halving effects, but institutional flows blur the old patterns and sometimes stretch them beyond recognition. September has reminded us that Bitcoin is not immune to macro shocks and that altcoins will always be the higher-beta victims when the tide goes out. The key difference today is that while retail waits for “altseason,” the real trigger may come from a pivot in bond markets, not from a halving chart on Twitter.

On a personal note, I took profits on September 12 and reduced most of my exposure. Since then I’ve been selectively buying dips on altcoins, positioning for the possibility of one last push or even a true altseason if it still comes. At the same time I’m keeping a close eye on the charts and the macro backdrop. If the market shows real weakness or breaks down further, I won’t hesitate to step aside again and sit in cash until the storm passes.