The Oil Market Is Flashing a Major Signal for Bitcoin

There’s a quiet but important shift happening in the energy markets that crypto investors should not ignore.

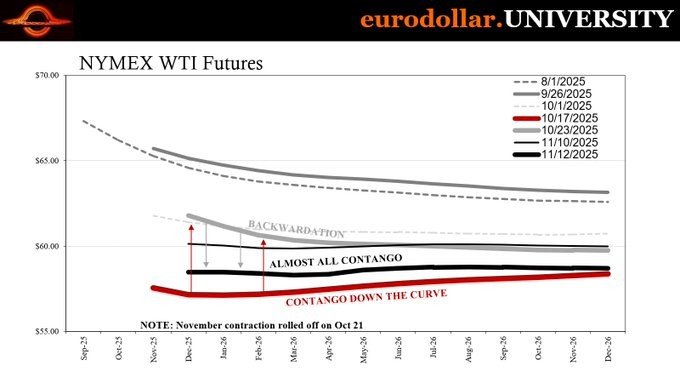

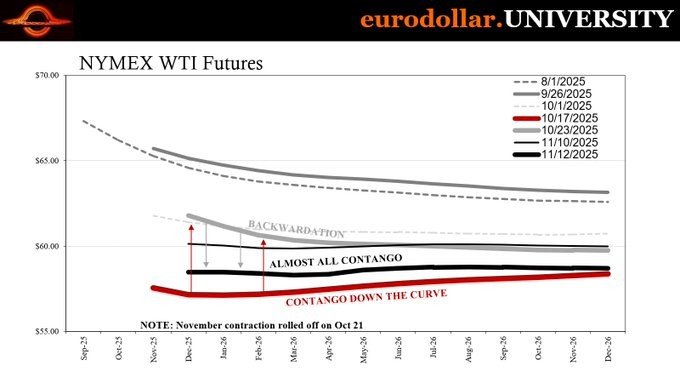

The entire

WTI futures curve has slipped into contango — meaning future contracts are now priced higher than oil delivered today.

That may sound like a technical detail, but historically it’s been one of the earliest and most reliable warnings that

global economic momentum is slowing. And when the macro cycle turns, Bitcoin tends to feel it.

What the Oil Curve Is Telling Us

Under normal conditions the oil market trades in

backwardation: spot oil is more expensive because demand is strong and inventories are tight.

But when the curve flips into contango, as it has now, traders are signaling:

“Short-term demand looks weak.”

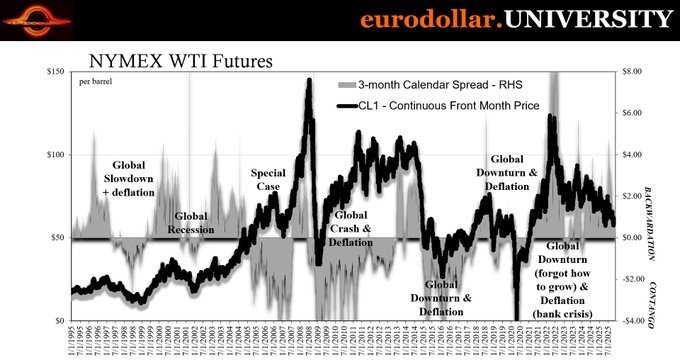

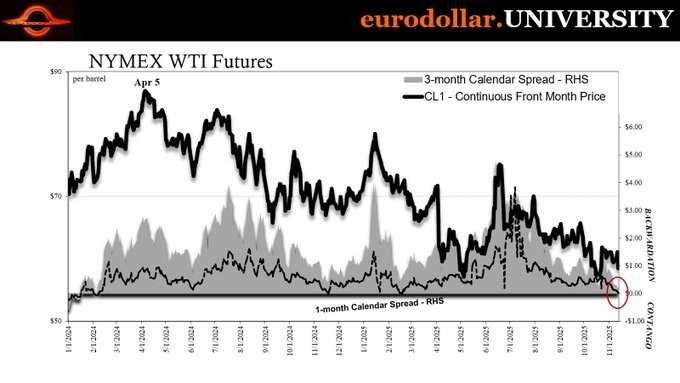

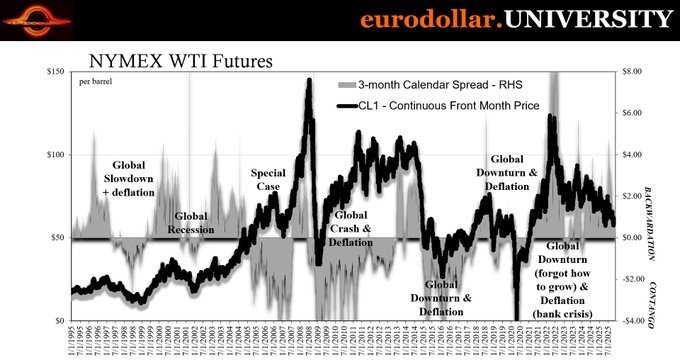

This shift rarely happens randomly. It preceded the slowdowns of

2001, 2008, 2015, 2020 and 2022.

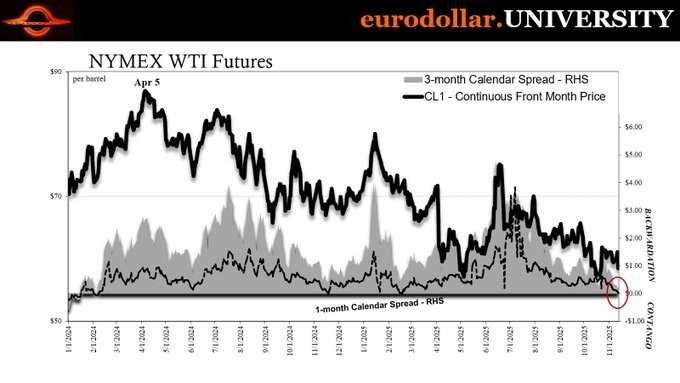

Calendar spreads in oil often move

before official economic data, which is why macro analysts treat them as one of the best early warnings in the market.

Why Contango Usually Means the Economy Is Cooling

A contango structure typically emerges when three forces line up:

- Demand softens

- Financial conditions tighten

- It becomes more profitable to store oil than to use it

That combination fits the profile of an economy losing momentum.

Other indicators agree: short-term rates (SOFR) are drifting lower, long-term yields are stuck, and credit spreads are widening.

What This Means for Bitcoin

Bitcoin is extremely sensitive to

global liquidity, risk appetite, and capital availability.

A cooling economy hits those inputs in several ways:

1. Slower growth = less liquidity

Banks and investors typically pull back when growth weakens.

Tighter financial conditions usually pressure risk assets: BTC, equities, high-yield credit.

2. Contango signals weaker energy and transport demand

This is historically a phase where investors turn defensive.

Bitcoin tends to outperform when liquidity is abundant and risk appetite is high — the opposite of what contango implies.

3. The timing of monetary policy becomes critical

If economic indicators keep deteriorating, central banks may eventually be forced to cut rates or expand liquidity.

That would be bullish

later — but Bitcoin often struggles during the slowdown phase

before stimulus returns.

Impact on Other Risk Assets

Contango periods usually bring:

- Higher volatility

- Lower valuations for risk assets

- Strength in defensive currencies (like the USD)

- Weaker performance in commodities tied to real economic activity

In other words: the oil curve is giving the same warning that credit markets, rates, and liquidity signals have been flashing for weeks.

Bottom Line

The move into contango doesn’t mean a recession is imminent.

But it

does suggest the global economy is transitioning into a

slower-growth phase — a macro backdrop where risk assets often struggle until central banks shift back toward easing.

For Bitcoin, this is an important signal to factor into positioning and expectations in the months ahead.