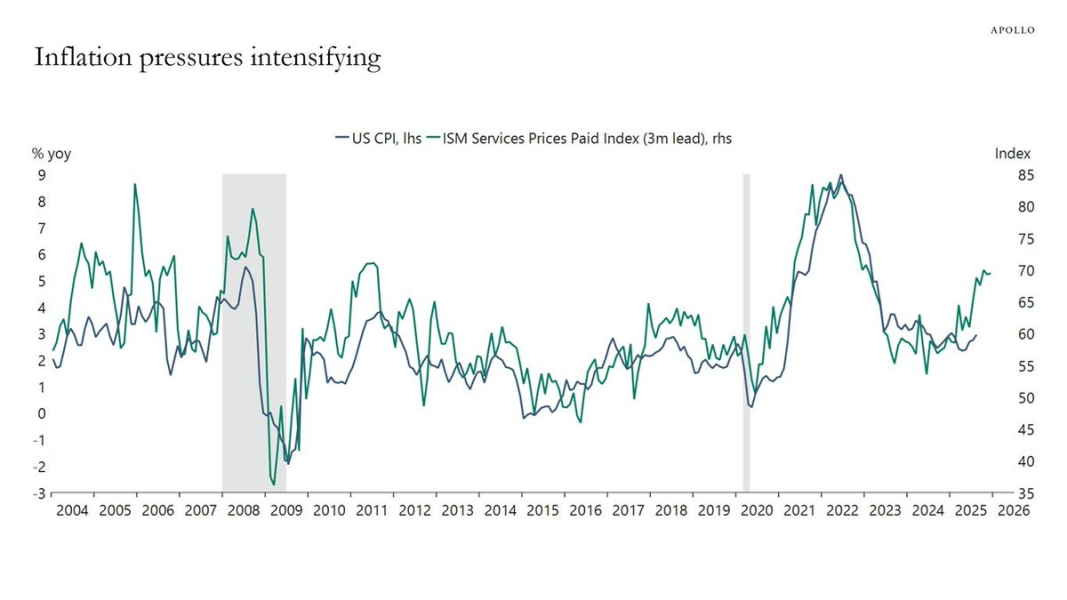

How can the US economy be growing so fast while the labor market is clearly under pressure?

Recent data and models show US economic growth hovering around 3%, possibly even pushing toward 4%. Yet, the Federal Reserve is still talking about cutting rates because the labor market is “cooling.” That sounds contradictory ,strong growth but weak jobs.

Torsten Sløk from Apollo offered an interesting breakdown of why job growth is slower than expected. First, lower immigration during the Trump era means fewer people are entering the country looking for work, which naturally limits new hires. Second, the rapid implementation of artificial intelligence is boosting productivity. Output is rising without needing more workers. And third, government hiring has fallen sharply. From 2022 to 2024, public-sector job creation was high compared to the private sector, but that reversed under the current administration.

So the labor market’s weakness doesn’t seem to come from a lack of demand, but rather a lack of supply. Companies still want to hire and invest, there just aren’t enough people to fill the roles. That’s why, despite the noise, the jobs market probably isn’t the Fed’s biggest headache right now.

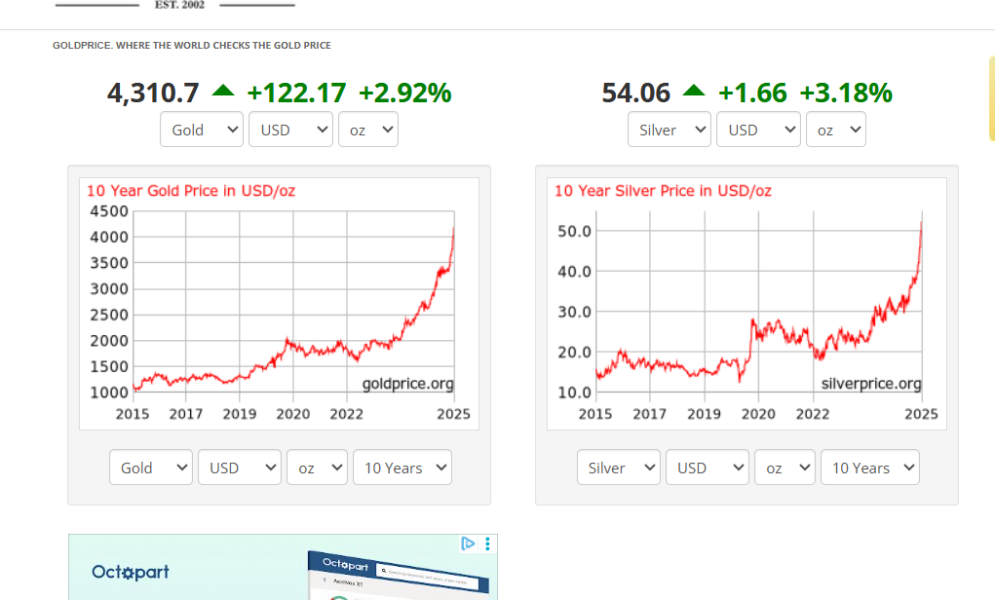

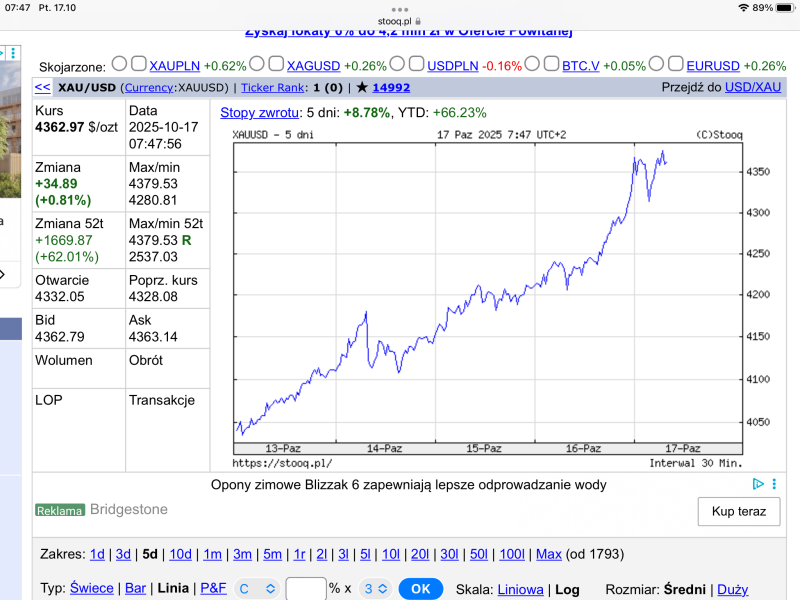

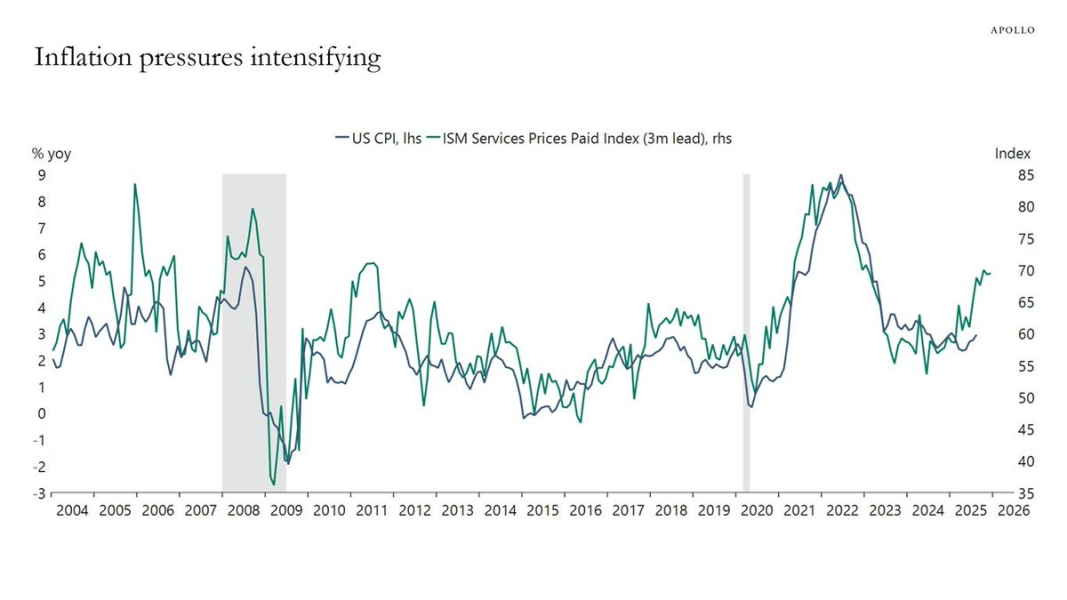

The real problem is inflation. That’s what’s lighting the fire under gold, which just broke through the symbolic $4,000 mark and sent half of finance Twitter into a full-blown gold fever.

Sure, we might see a short-term correction, whenever everyone starts screaming “buy gold,” you know a pullback isn’t far off. But longer term, I don’t see any reason why the gold bull run should stop here. Not if central banks keep stimulating growth and quietly letting inflation run hot. In that world, the real safe haven isn’t cash, it’s the shiny stuff that central banks themselves can’t print.