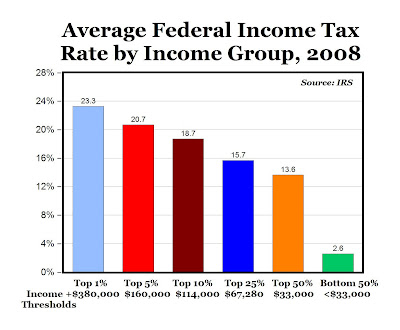

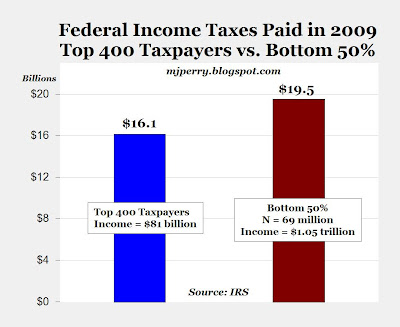

Actually the US Tax system is highly progressive. The top 10 percent of income earners paid 71 percent of all federal income taxes in 2009 though they earned 43 percent of all income. The bottom 50 percent paid 2 percent of income taxes but earned 13 percent of total income. About half of tax filers paid no federal income tax at all.

The richest 400 families paid nearly as much income tax as the bottom 50%...Stunning:

I admire Buffett and am a long time Berkshire owner but he's a hypocrite here. If he were serious, he'd send his estate to the IRS instead of the Gates' Foundation.

Sorry, jazzdoc, but this is simply RUBBISH.

COLLECTIVELY the richest may have paid 70% of the taxes, but individually they BARELY FEEL THE PINCH.

Not to mention that a HUGE chunk of the wealthiest tax payers income are from passive pursuits, and more importantly, a legacy

of ill gotten gains, and rules put into place to serve them, and billions in tax shelters. Please, enough of the distortions.

The salaried class gets SLAUGHTERED..especially with payroll taxes, which are utterly meaningless to the top 1%.

Secondly, that is utter nonsense about Buffet.