Finances | Business | Investments | Tesla Shares

- Thread starter NorthStar

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

And my gold stock AUY taking a hit today almost - 9 %.

Gold did nt even move

Markets are so unpredictable

Gold did nt even move

Markets are so unpredictable

Last edited:

Definitely not the time to sell unless you need cash out. Otherwise at this point I’d ride out the storm which will likely get worse before better.Well, right now might as well cash in and put your money inside a pillow case.

it all depends on how tight your anal sphincter is

Given what’s going in in the market this would be the time for you to buy gold because you’re right people are looking to put their cash into other assets and gold prices buy sell rates change dailyAnd my gold stock AUY taking a hit today almost - 9 %.

Gold did nt even move

Markets are so unpredictable

I've been there Steve. Each person for himself, save the boat before the storm ...

Tesla? https://www.reuters.com/article/us-...us-hits-china-car-registrations-idUSKCN20L2LD

I bet a lot of investors right now are on the phones and computers with their stock brokers and financial advisors, it must be real buzzy.

And yes, gold is usually a safe heaven in situations like these.

Tesla? https://www.reuters.com/article/us-...us-hits-china-car-registrations-idUSKCN20L2LD

I bet a lot of investors right now are on the phones and computers with their stock brokers and financial advisors, it must be real buzzy.

And yes, gold is usually a safe heaven in situations like these.

Gold is in a predicament here because you have a situation of possibly economic chaos till the end of 2020. India and China are some of the largest holders. The big question will China sell to raise liquid funds.

If and I say if Gold’s recent rise was a B wave them a C wave down would target about 1100 or so. That would end golds bear market.

Take this with a grain of salt....just a chart junkie.

If and I say if Gold’s recent rise was a B wave them a C wave down would target about 1100 or so. That would end golds bear market.

Take this with a grain of salt....just a chart junkie.

Just my 2 cents on the stock market. Lot’s of overhead supply here.

Warren Buffett last Friday released his annual letter regarding his empire Berkshire Hathaway.

IIRC 2018 was dismal and one thing about 2019 it was a banner year. But I think there’s a catch to his 83 Billion $ profit....Warren pointed out that out of the 83B in profits...54B was unrealized profits in BK’s stock portfolio. He is not the only one either. Nobody got out....that’s why the drop has been so swift and the rallies are sharp and intraday.

You never want to be forced to liquidate in a down market like this...but sometimes you may be forced to.

Warren Buffett last Friday released his annual letter regarding his empire Berkshire Hathaway.

IIRC 2018 was dismal and one thing about 2019 it was a banner year. But I think there’s a catch to his 83 Billion $ profit....Warren pointed out that out of the 83B in profits...54B was unrealized profits in BK’s stock portfolio. He is not the only one either. Nobody got out....that’s why the drop has been so swift and the rallies are sharp and intraday.

You never want to be forced to liquidate in a down market like this...but sometimes you may be forced to.

Today the Dow Jones industrial average lost 1,200 points!

If anyone is trying to make you believe that the sky is blue when it's actually red and burning and there is potential in the dark blackness; tel him to go boil an egg.

• https://www.marketwatch.com/story/s...-but-dont-argue-says-chart-watcher-2020-02-27

In Canada they halted the TSX from a free fall for all!

Follow your heart, you maternal instinct, don't read the news and the unknown, stay the course and bail out now before you lose your shirt, your pants, your runners, your hat, your underwears and your socks. Or till you die of a heart attack or crash your Tesla onto a utility pole or run out of food or simply catch a bad nasty cold.

If anyone is trying to make you believe that the sky is blue when it's actually red and burning and there is potential in the dark blackness; tel him to go boil an egg.

• https://www.marketwatch.com/story/s...-but-dont-argue-says-chart-watcher-2020-02-27

In Canada they halted the TSX from a free fall for all!

Follow your heart, you maternal instinct, don't read the news and the unknown, stay the course and bail out now before you lose your shirt, your pants, your runners, your hat, your underwears and your socks. Or till you die of a heart attack or crash your Tesla onto a utility pole or run out of food or simply catch a bad nasty cold.

What tomorrow (Friday) might bring (no surprise) ...

• https://www.cnbc.com/2020/02/27/dow...ther-massive-rout-amid-coronavirus-fears.html

And on the Australian, Japan, Asian markets ...

• https://www.cnbc.com/2020/02/28/asia-markets-wall-street-in-correction-coronavirus-in-focus.html

• https://www.cnbc.com/2020/02/27/dow...ther-massive-rout-amid-coronavirus-fears.html

And on the Australian, Japan, Asian markets ...

• https://www.cnbc.com/2020/02/28/asia-markets-wall-street-in-correction-coronavirus-in-focus.html

And my gold stock AUY taking a hit today almost - 9 %.

Gold did nt even move

Markets are so unpredictable

I like gold in the form of physical gold or in the form of the GLD ETF. But I learned a long time ago that gold stocks seem to fail you just when you need them most. During market crashes gold stocks are much more like stocks than gold.

Chaos in the world financial markets, that would be a gross understatement.

About a financial pandemonium that if I would put in picture to describe it ...

No panic, everyone looks calm. ...And uncertain, very. The masks they're wearing are the giveaway. In China, in polluted cities with near zero visibility, and also parts of India, etc., we are used to see the citizens wearing surgical masks in the streets, when we are watching news and docs on TV.

What we're less used to see are them masks everywhere in the world except in Antarctica.

And that, makes the markets react.

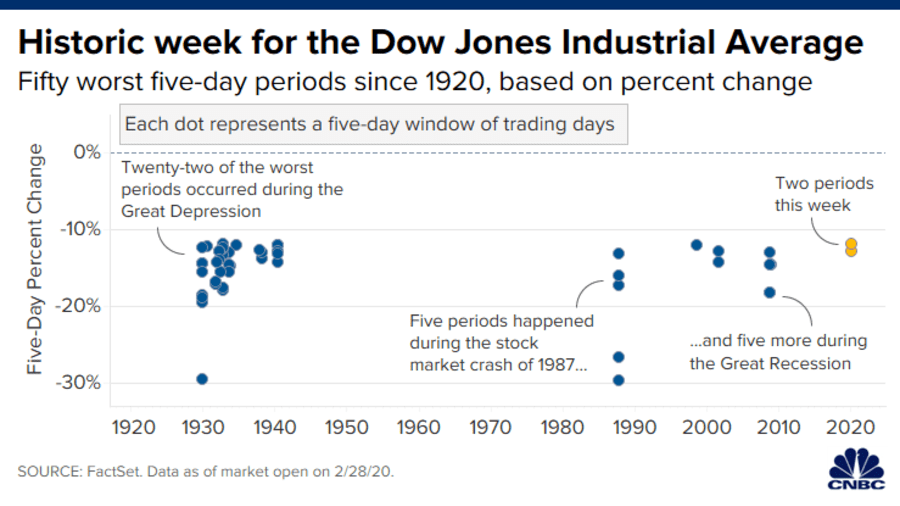

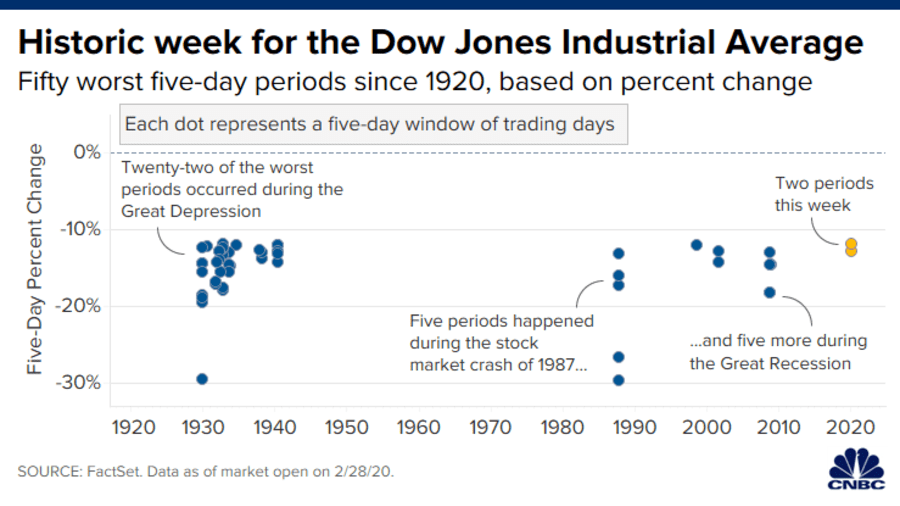

It goes without saying that this week they are comparing it historically since 99.999999999999999% of us weren't even born ... 1920

Major bank economist says the coronavirus market reaction ‘boggles the mind’

A pic is worth thousand words ...

About a financial pandemonium that if I would put in picture to describe it ...

No panic, everyone looks calm. ...And uncertain, very. The masks they're wearing are the giveaway. In China, in polluted cities with near zero visibility, and also parts of India, etc., we are used to see the citizens wearing surgical masks in the streets, when we are watching news and docs on TV.

What we're less used to see are them masks everywhere in the world except in Antarctica.

And that, makes the markets react.

It goes without saying that this week they are comparing it historically since 99.999999999999999% of us weren't even born ... 1920

Major bank economist says the coronavirus market reaction ‘boggles the mind’

A pic is worth thousand words ...

Last edited:

Hectic financial week ...

Dow

? https://www.marketwatch.com/investing/stock/tsla

Dow

- The Dow (INDU) closed 357 points, or 1.4%, lower, on its seventh day in the red.

- At its worst, the index was down nearly 1,086 points (Friday, February 28)

- It dropped 3,583 points this week, including its worst one-day point drop in history on Thursday. On a percentage basis, Thursday's 4.4% slump was the worst performance since February 2018.

- It was its worst week since October 2008, as it fell 12.4%.

? https://www.marketwatch.com/investing/stock/tsla

Last edited:

This stock-market expert said that 'this market is not normal' ... I think he's right ... 100%

• https://www.marketwatch.com/story/s...n-a-week-this-market-is-not-normal-2020-02-28

Over 1,200 comments ... (I only read few).

• https://www.marketwatch.com/story/s...n-a-week-this-market-is-not-normal-2020-02-28

Over 1,200 comments ... (I only read few).

Scary prospect ... very

• https://www.businessinsider.com/sto...um-professor-warns-of-colossal-decline-2020-2

• https://www.businessinsider.com/sto...um-professor-warns-of-colossal-decline-2020-2

What’s not normal is when the Federal Reserve does QE and calls it unprecedented Repos into a very extended stock market. Then has the nerve to say the market is overextended...C’mon man they are the biggest bullshitters on earth. They did the exact same thing six months before 1929 and every bubble since.This stock-market expert said that 'this market is not normal' ... I think he's right ... 100%

• https://www.marketwatch.com/story/s...n-a-week-this-market-is-not-normal-2020-02-28

Over 1,200 comments ... (I only read few).

I’m not the smartest bulb...but this market was going to come down no matter what. God help us if the rally up is a 3 wave. I’ll short the shit out of again. End of rant...the system is rigged but as long as your long the world is fine.

Remember one thing...the trend is your friend. I count 5 down in the SPX futures...that tells me the trend has changed. Bull markets do 5 waves up and 3 waves down. Bear markets do the exact opposite. Watch the financials...they will tell you all you need to know.Off course its completely rigged i agree .

But to play the trading game well is what matters off course.

There is a saying that there are 2 types of traders that lose the most money.

The ones that know nothing and the ones that think they know .

Brg hj

Similar threads

- Replies

- 8

- Views

- 694

- Replies

- 13

- Views

- 3K

- Sticky

- Replies

- 34

- Views

- 20K

- Replies

- 22

- Views

- 3K

Members online

- andi

- Neil.Antin

- thomask

- Sampajanna

- pdxaudio

- trekpilot

- Glide3

- ChrisSoundLab

- adamaley

- jbrrp1

- lwr

- Rexp

- T Boost

- shawnf

- KPC

- findog

- abeidrov

- abaudio10

- LarryK

- keithc

- SaiteiMan

- kotjac

- sthekepat

- DividedSky

- PYP

- moby2004

- jadedavid

- Massimo66

- redscouser

- TRHH

- Designsfx

- norm

- flowcharts

- audiobomber

- Ackcheng

- Backpacker

- Salectric

- mtemur

- earl3090

- Geoffkait

- Michaelbbubles

- Pallen

- kennyb123

- escultor

- rob

- puroagave

- Kyle1

- oldmustang

- five

- Bushikai

Total: 1,339 (members: 61, guests: 1,278)

| Steve Williams Site Founder | Site Owner | Administrator | Ron Resnick Site Co-Owner | Administrator | Julian (The Fixer) Website Build | Marketing Managersing |